Newsroom

News & Information Articles

NYSIF Rate Update Effective October 1, 2020

On July 15, 2020, the NY Department of Financial Services (DFS) approved the NY Compensation Insurance Rating Board’s (NYCIRB) filing of revised WC loss costs to be effective for policies effective on or after October 1, 2020. This new filing decreases Workers’ Compensation loss costs an average of 1.0 percent. Outside of any changes to the New York State Insurance Fund’s Loss Cost Multiplier (LCM) of 1.27, these percentage changes in the loss costs will directly correlate to the NYSIF rates effective on or after October 1, 2020.

For current Fleury Risk Management Safety Group and Group 90 policyholders, these rate changes will not be effective until your 2021 policy renewals. Even though the average loss cost decrease for all class codes is 1.0 percent, please review your policy’s individual class codes in order to understand the potential impact these changes will have on your upcoming renewal.

The 1.0 percent average loss cost decrease for the upcoming period is directly tied to multiple factors including: improvement in overall loss experience, legislative and regulatory changes, and future trends.

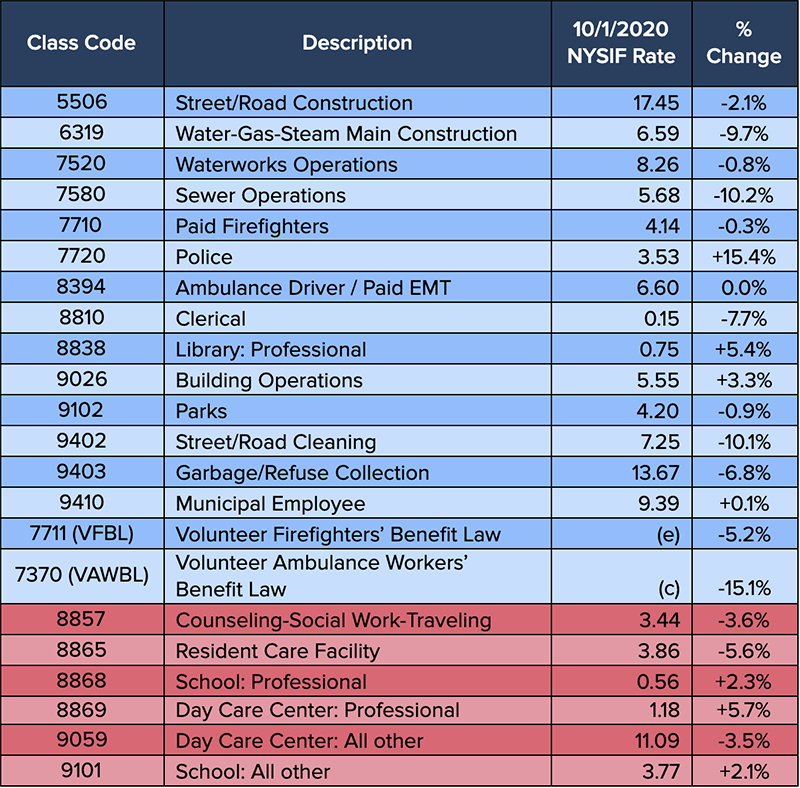

Below is a list of class codes reflected on most of Fleury Risk Management’s customer policies, including their percentage rate change for the next policy renewal period. It is important to note there are a number of other variable factors used to calculate your workers’ compensation insurance premium. These variables include: experience modification factor, payroll/exposure changes, NYS Assessment Charge, and policy discounts are subject to change each year and play an important role in determining your insurance premium. If you have any questions regarding this bulletin or would like information on a class code not included on this list below, please contact our office.